Add Credit Card Fees to Invoices in QuickBooks Online

Some jurisdictions now allow you to pass on the cost of credit card processing. This is not the case everywhere – so do check that you are allowed to do this before adding the charge to your customers’ invoice.

If this is an option for you I have created a video to show you how to set it up!

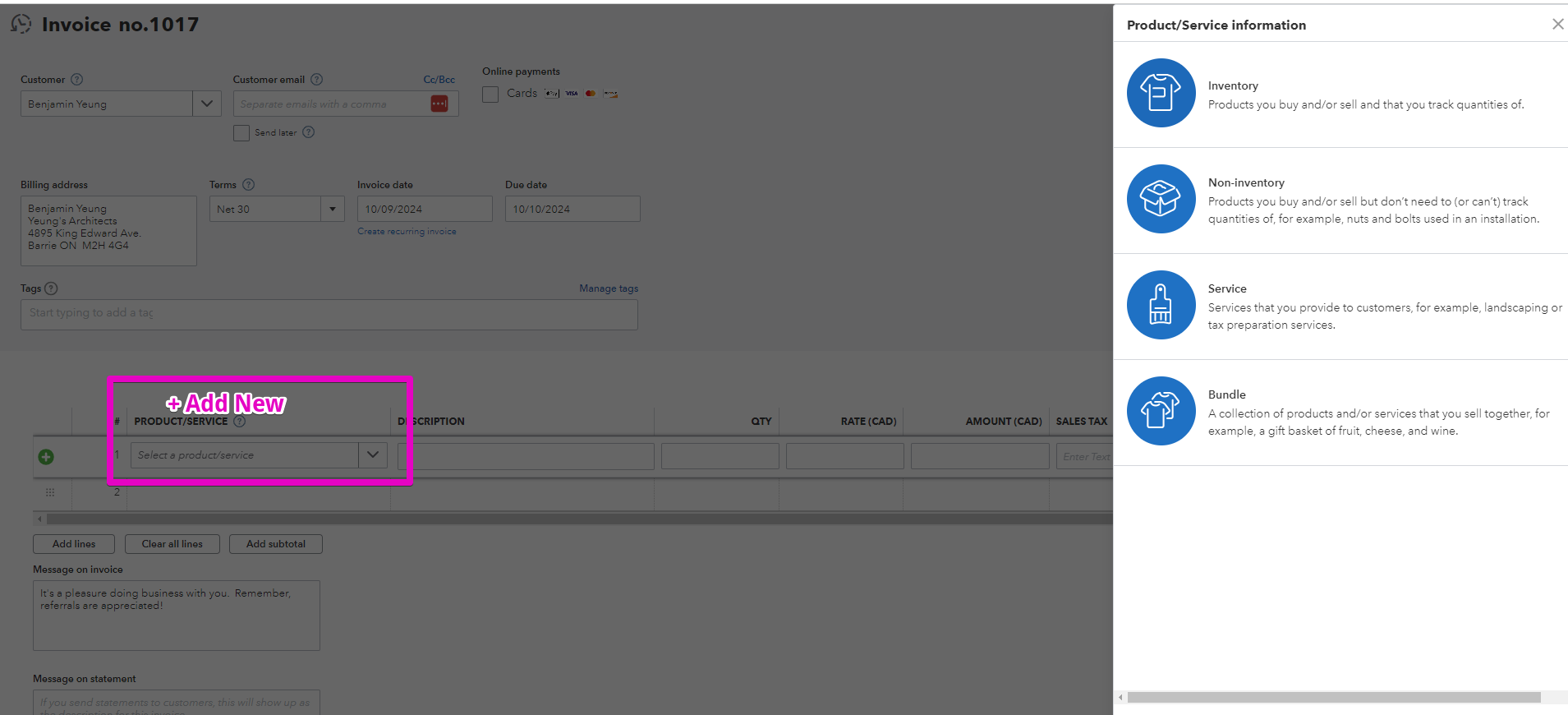

You can create a new product/service to charge your credit card fees directly from the invoice

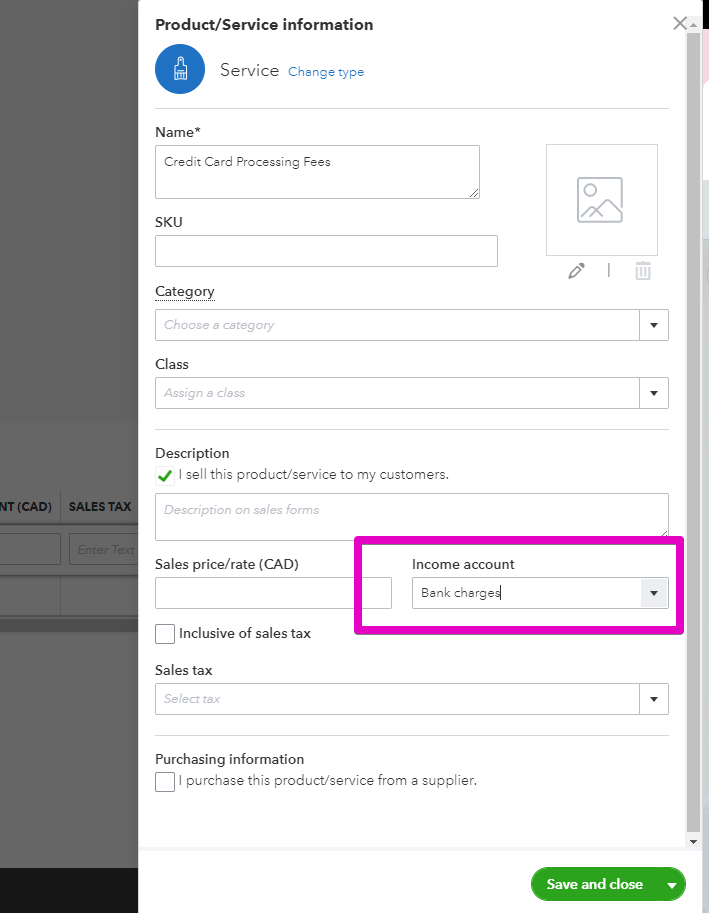

From this pop up you decide where you would like to allocate the fees you collect. You can select an income or expense account. Or create a new category to keep track of the amounts you collect separately.

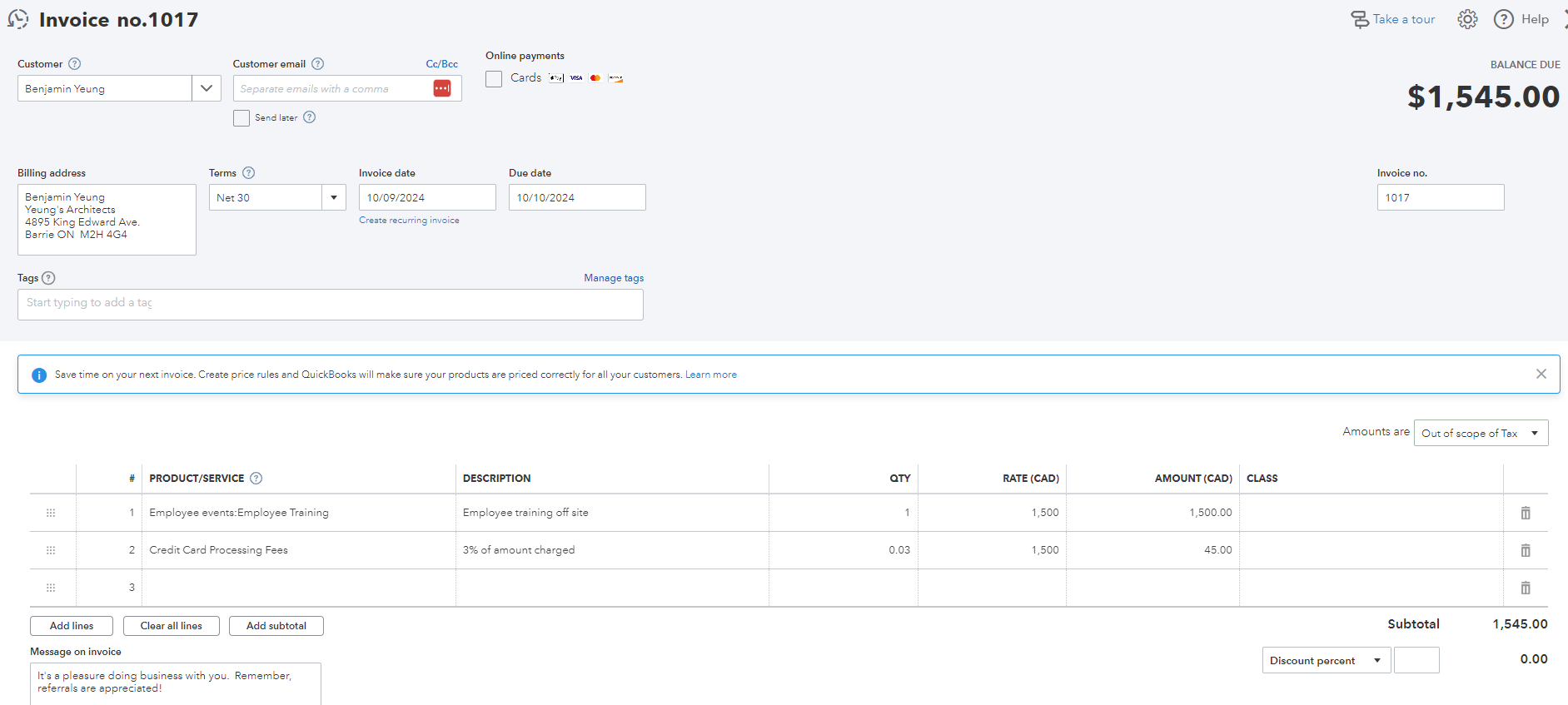

You can then add the credit card processing fee to your invoice and recoup the cost immediately!

The general options enable you to change the way your report displays, this is particularly useful if you are printing, customizing, or sending your reports.

If this is allowed in your jurisdiction it can really help to recapture some of the costs of collection.

Don't hesitate to reach out if you have any further questions, and check out further options below:

Download a free MonthEnd Checklist to help ensure your books are accurate and up to date!

Still need help?

Check this out.

QuickBooks Online Plan Comparison

Checkout the latest offers on QuickBooks Online Plans and compare features

Let's go!Still need help?

Book a session! We can work together to solve your specific QuickBooks Online questions.

Let's go!Add Credit Card Fees to Invoices in QuickBooks Online

Kerry: [00:00:00] Hi, Kerry here from My Cloud Bookkeeping. I work with small businesses and entrepreneurs to help them manage their business finances in QuickBooks Online. If you're not sure if you're using the best plan for your business, check out my plan comparison below. Be sure to watch right to the end for useful tips for your business.

Some jurisdictions now allow you to pass on the cost of credit card processing to your customers. Now, this is not the case any everywhere, so So do check that you're allowed to do this before adding the charges to your customer's invoice. Now, if this is an option for you, let's dive in and set it up.

Now here we are in the sample company and we want to charge our customer for recent services. So we're going to grab an invoice here, select our customer. Let's go with Benjamin. And we're going to sell him. Let's sell him some employee training, 1, 500. I know we ignore tax for the sake of this exercise.

We're [00:01:00] just going to put zero on it. Um, let's add some other things in here as well. Let's get some name badges. We'll get maybe $50 of them. Um, no sales tax and put exempt on these. Please just ignore what I'm putting for sales tax. And then we'll grab, uh, what else can we get? Let's get a guest book. Guest book for $25.

And we'll, we'll put this one out of scope just to make it really confusing. So what we have now is we have an invoice here for $3,028 and Benjamin wants to pay us via credit card. We don't really want him to pay by a credit card because it's going to cost us 3%. That's, that's what we're going with for this example.

So we need to have a product or a service that we can charge for credit card fees. So I'm going to pop down here and I'm going to click add new. Now, what pops up here is the product service information. So you can also get to hear from products and services in the sales section. I'm [00:02:00] clicking service.

I'm going to call it credit card fees, and then we need to allocate the money that we collect for this to an account. Now, we could create an income account, a new income account that's credit card fees collected. We could also choose an expense account and perhaps offset it from the bank charges or the credit card charges from the company.

There are so many different ways we could do this. I'm going to opt for putting it into income. Just for the sake of being a little bit less confusing, but hopefully you kind of get an idea of what your options are there. So I'm now going to go, I'm going to add a new account. So here we are now in the chart of accounts set up.

So part of the beauty of this is that we can allocate all these different sections and do our setup while we're sitting in the invoice, which is kind of cool. I'm just going to say it's service fee income, and I'm going to call it [00:03:00] a credit card fee. Okay. So now we have just created an income account in our chart of accounts, so a new category.

We've created a new product or service called Credit Card Fees. And now we're going to go Save and Close. So we then have the option to use this credit card fee. Now what I would do here is, If I know that I'm going to be charging my customer 3%, and I can see that the, the balance before I do that is $3,028.

I'm going to say I'm charging them 0. 03 times 3028, and then it will calculate what that 3% is. So then when we send them their invoice, they're now going to get an invoice for $3,118.84, because it includes that surcharge. So let's save this. And we'll have a quick look at what our income statement looks like with those fees in there.

So we'll go [00:04:00] to reports, grab the profit and loss. And we can see here the credit card fee for 90. 84. And as I mentioned, our other option would be to have it down here as a minus within the expenses. So this way we can see what we've brought in. The other way we can kind of net them off against each other to get an idea to see if we're collecting enough.

Hopefully that will help you to set up the charge to recoup some of the costs of collecting from your customers, but it's not enough to just add the fees in order to keep on top of what your customers owe you. It's important to regularly run your accounts receivable report, so download my Month End checklist below to ensure you are getting all the information you need to manage your business finances, and what you are looking at is accurate.

If you have any questions or comments, please make a note below. I'd love to hear from you.

[00:05:00] Cheers.

Add Credit Card Fees to Invoices in QuickBooks Online

Kerry: [00:00:00] Hi, Kerry here from My Cloud Bookkeeping. I work with small businesses and entrepreneurs to help them manage their business finances in QuickBooks Online. If you're not sure if you're using the best plan for your business, check out my plan comparison below. Be sure to watch right to the end for useful tips for your business.

Some jurisdictions now allow you to pass on the cost of credit card processing to your customers. Now, this is not the case any everywhere, so So do check that you're allowed to do this before adding the charges to your customer's invoice. Now, if this is an option for you, let's dive in and set it up.

Now here we are in the sample company and we want to charge our customer for recent services. So we're going to grab an invoice here, select our customer. Let's go with Benjamin. And we're going to sell him. Let's sell him some employee training, 1, 500. I know we ignore tax for the sake of this exercise.

We're [00:01:00] just going to put zero on it. Um, let's add some other things in here as well. Let's get some name badges. We'll get maybe $50 of them. Um, no sales tax and put exempt on these. Please just ignore what I'm putting for sales tax. And then we'll grab, uh, what else can we get? Let's get a guest book. Guest book for $25.

And we'll, we'll put this one out of scope just to make it really confusing. So what we have now is we have an invoice here for $3,028 and Benjamin wants to pay us via credit card. We don't really want him to pay by a credit card because it's going to cost us 3%. That's, that's what we're going with for this example.

So we need to have a product or a service that we can charge for credit card fees. So I'm going to pop down here and I'm going to click add new. Now, what pops up here is the product service information. So you can also get to hear from products and services in the sales section. I'm [00:02:00] clicking service.

I'm going to call it credit card fees, and then we need to allocate the money that we collect for this to an account. Now, we could create an income account, a new income account that's credit card fees collected. We could also choose an expense account and perhaps offset it from the bank charges or the credit card charges from the company.

There are so many different ways we could do this. I'm going to opt for putting it into income. Just for the sake of being a little bit less confusing, but hopefully you kind of get an idea of what your options are there. So I'm now going to go, I'm going to add a new account. So here we are now in the chart of accounts set up.

So part of the beauty of this is that we can allocate all these different sections and do our setup while we're sitting in the invoice, which is kind of cool. I'm just going to say it's service fee income, and I'm going to call it [00:03:00] a credit card fee. Okay. So now we have just created an income account in our chart of accounts, so a new category.

We've created a new product or service called Credit Card Fees. And now we're going to go Save and Close. So we then have the option to use this credit card fee. Now what I would do here is, If I know that I'm going to be charging my customer 3%, and I can see that the, the balance before I do that is $3,028.

I'm going to say I'm charging them 0. 03 times 3028, and then it will calculate what that 3% is. So then when we send them their invoice, they're now going to get an invoice for $3,118.84, because it includes that surcharge. So let's save this. And we'll have a quick look at what our income statement looks like with those fees in there.

So we'll go [00:04:00] to reports, grab the profit and loss. And we can see here the credit card fee for 90. 84. And as I mentioned, our other option would be to have it down here as a minus within the expenses. So this way we can see what we've brought in. The other way we can kind of net them off against each other to get an idea to see if we're collecting enough.

Hopefully that will help you to set up the charge to recoup some of the costs of collecting from your customers, but it's not enough to just add the fees in order to keep on top of what your customers owe you. It's important to regularly run your accounts receivable report, so download my Month End checklist below to ensure you are getting all the information you need to manage your business finances, and what you are looking at is accurate.

If you have any questions or comments, please make a note below. I'd love to hear from you.

[00:05:00] Cheers.

Still need help?

Check this out.

QuickBooks Online Plan Comparison

Checkout the latest offers on QuickBooks Online Plans and compare features

Let's go!Still need help?

We have what you need. Check out our courses and free resources to get more help managing your finances.

Let's go!.png)