Recording PST commission in QuickBooks Online

When I created the video showing how to prepare and record your PST return using QuickBooks Online I did not use the correct category for the PST commission!

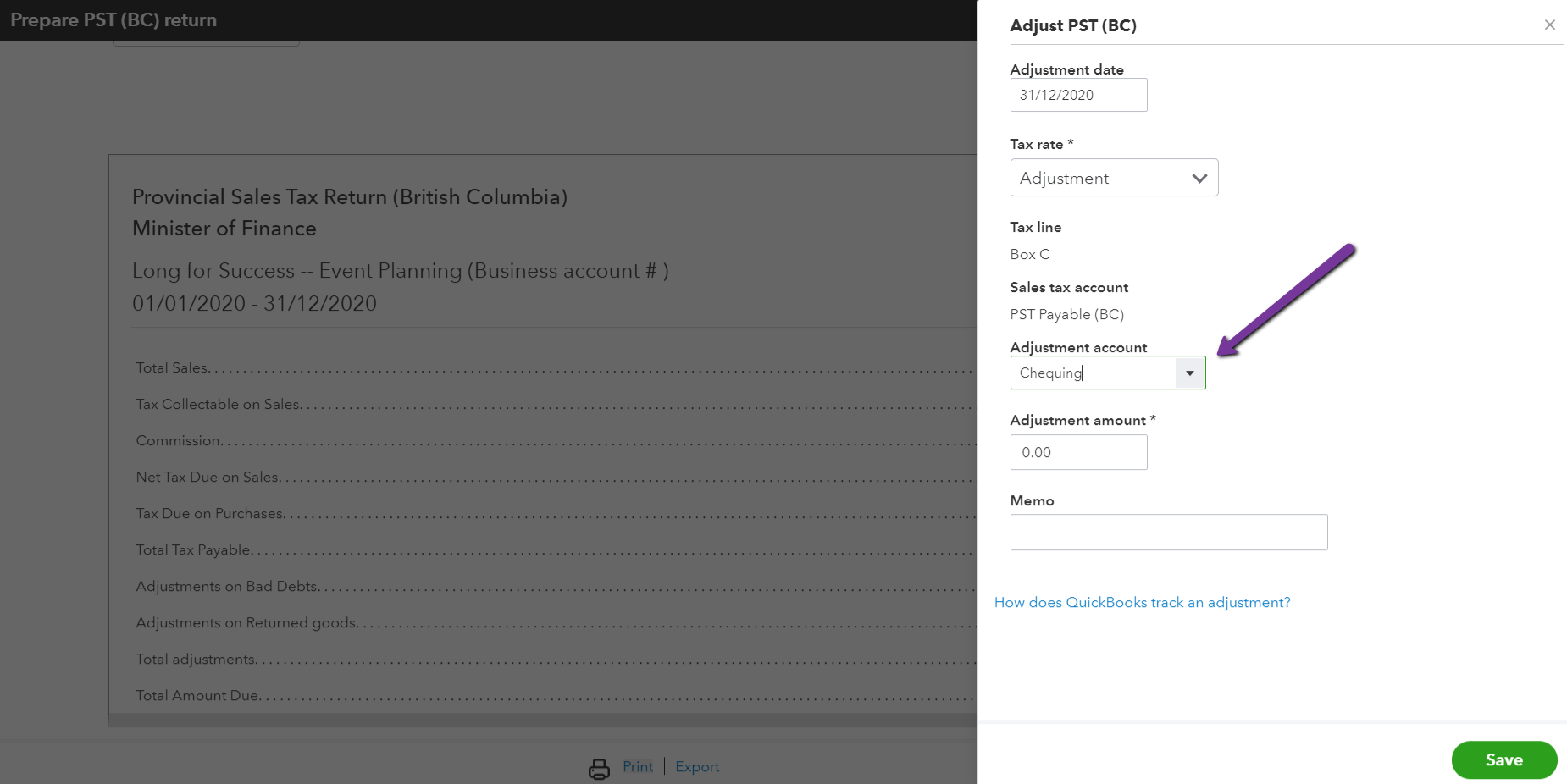

When entering the commission amount you are required to select a category to record the "adjustment" or PST commission to. The default account is the first account in your chart of accounts, normally your bank account. Clearly not correct!

It is important to select the appropriate account to record the commision to before saving the adjustment, otherwise when you come to reconcile your bank account you will have these annoying commission amounts that you won't know what to do with!

This video shows how to select the correct account for PST commission - and set up a new account if you don't have one.

Still need help?

Check this out.

Recording PST Commission in QuickBooks Online

If you don't select the correct account when recording PST commission in QuickBooks it will be posted to a default account, which is normally not the correct account! In this QuickBooks tutorial, I show you where to record the PST commission, and how to change the account or category that it is posted to.

Let's go!Still need help?

Book a session! We can work together to solve your specific QuickBooks Online questions.

Let's go!Video Transcript:

Hi, Kerry here from My Cloud Bookkeeping. I’m not too sure if you’ve had this problem when you’re reconciling your bank account and PST commission amounts appear randomly, and you have no idea how you got there. Well, today I’m going to show you how to set up the PST commission so it goes to the correct account and it doesn’t appear in your bank again and you don’t have that problem.

Here we are in the sample company, select taxes on the left-hand tab; you can either scroll or use the drop down to select PST. Now, as you can see we have $35,00 in PST owing, if you followed through my other video you will have been to the e-tax site to prepare the PST return for the province and now know how much you owe. So let’s click into here, we’re going to enter a commission of $22, select adjust, now notice that the adjustment account here is defaulting to checking, makes absolutely no sense and I suspect it’s because it’s the top category in the chart of accounts.

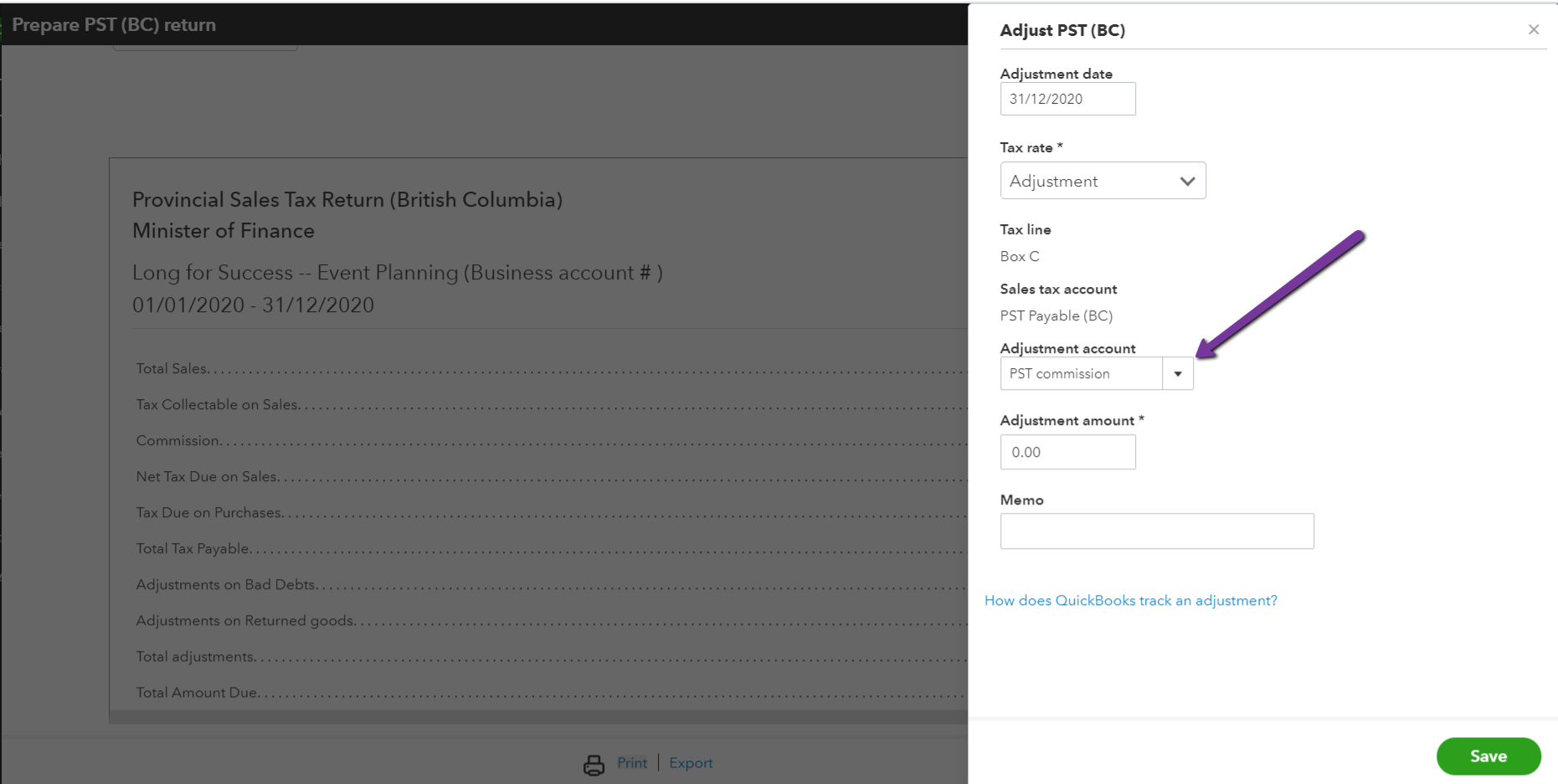

If you watched my other video, this was probably sitting here, and I’m so sorry for that. If you don’t change this, your bank balance is going to be incorrect and you won’t be able to reconcile it. What we want to do is select something that’s going to appear on the income statement. So let’s have a look and see if there is anything in here for PST. Ah, PST expense—(BC), let’s grab this one, and we put in our amount of $22. Now, we can make a note here that this is our PST commission and save. Now, if this agrees to what you found on the PST site, you can choose “mark filed”. Yes, all done.

Now, you know how I love my reports. So let’s have a quick look at the profit loss and see how this shows up. So you can see here we have a PST expense, it has a negative $22; at least it’s on the income statement and not in the bank. Now, if you prefer to see this as income, you can change the account in the chart of accounts. If you’re still with me, let’s do that now. So go to accounting on the left-hand tab, select chart of accounts, click PST, choose the PST expense account, edit and we can change the type here, in “Other Income” That is not here, it’s right here, we’ll just pop in, call it income, it’s fine, and save and close. Now, let’s have a quick look and see what our report looks like.

Here we have down here–still says PST expense, you could change the name as well, but at least it’s showing up as a positive number as other income– much tidier.

Correcting past sales tax returns is tricky. Accountants have a tool whereby they can undo previously filed sales tax returns and then re-file them with amounts corrected; you have to be really careful doing that. If you’d like my help, reach out or reach out to your accountant, other than that, perhaps you could do a journal entry to move PST commission to where it’s supposed to be.

There’s a link to my calendar below; you can also write in the comment box if there’s anything you like help with. If this video was useful click like, subscribe to my channel. Also, there’s my newsletter link down there below. If you get the month end checklist, you’ll be signed up and I will let you know if there are any changes in QuickBooks and the apps I’m exploring, there could be some useful information. If there’s anything else you’d like to know about, let me know, and my next video could be for you.

Cheers!

Video Transcript:

Hi, Kerry here from My Cloud Bookkeeping. I’m not too sure if you’ve had this problem when you’re reconciling your bank account and PST commission amounts appear randomly, and you have no idea how you got there. Well, today I’m going to show you how to set up the PST commission so it goes to the correct account and it doesn’t appear in your bank again and you don’t have that problem.

Here we are in the sample company, select taxes on the left-hand tab; you can either scroll or use the drop down to select PST. Now, as you can see we have $35,00 in PST owing, if you followed through my other video you will have been to the e-tax site to prepare the PST return for the province and now know how much you owe. So let’s click into here, we’re going to enter a commission of $22, select adjust, now notice that the adjustment account here is defaulting to checking, makes absolutely no sense and I suspect it’s because it’s the top category in the chart of accounts.

If you watched my other video, this was probably sitting here, and I’m so sorry for that. If you don’t change this, your bank balance is going to be incorrect and you won’t be able to reconcile it. What we want to do is select something that’s going to appear on the income statement. So let’s have a look and see if there is anything in here for PST. Ah, PST expense—(BC), let’s grab this one, and we put in our amount of $22. Now, we can make a note here that this is our PST commission and save. Now, if this agrees to what you found on the PST site, you can choose “mark filed”. Yes, all done.

Now, you know how I love my reports. So let’s have a quick look at the profit loss and see how this shows up. So you can see here we have a PST expense, it has a negative $22; at least it’s on the income statement and not in the bank. Now, if you prefer to see this as income, you can change the account in the chart of accounts. If you’re still with me, let’s do that now. So go to accounting on the left-hand tab, select chart of accounts, click PST, choose the PST expense account, edit and we can change the type here, in “Other Income” That is not here, it’s right here, we’ll just pop in, call it income, it’s fine, and save and close. Now, let’s have a quick look and see what our report looks like.

Here we have down here–still says PST expense, you could change the name as well, but at least it’s showing up as a positive number as other income– much tidier.

Correcting past sales tax returns is tricky. Accountants have a tool whereby they can undo previously filed sales tax returns and then re-file them with amounts corrected; you have to be really careful doing that. If you’d like my help, reach out or reach out to your accountant, other than that, perhaps you could do a journal entry to move PST commission to where it’s supposed to be.

There’s a link to my calendar below; you can also write in the comment box if there’s anything you like help with. If this video was useful click like, subscribe to my channel. Also, there’s my newsletter link down there below. If you get the month end checklist, you’ll be signed up and I will let you know if there are any changes in QuickBooks and the apps I’m exploring, there could be some useful information. If there’s anything else you’d like to know about, let me know, and my next video could be for you.

Cheers!

Still need help?

Check this out.

Recording PST Commission in QuickBooks Online

If you don't select the correct account when recording PST commission in QuickBooks it will be posted to a default account, which is normally not the correct account! In this QuickBooks tutorial, I show you where to record the PST commission, and how to change the account or category that it is posted to.

Let's go!Still need help?

We have what you need. Check out our courses and free resources to get more help managing your finances.

Let's go!.png)